LIFE

20 Easy Ways to Simplify and Organize Your Financial Life

Published

5 days agoon

Shutterstock

Staying financially organized is essential for maintaining control over your money and achieving your goals. With a little planning and consistency, you can simplify your finances, reduce stress, and build a more secure future. From creating a solid budget to automating savings and payments, these practical steps will help you manage your money effectively. Whether you’re saving for retirement, paying off debt, or simply trying to stay on top of monthly expenses, financial organization is the key. Explore these 20 actionable ways to get your financial life in order and enjoy greater peace of mind.

Create a Budget and Stick to It

Shutterstock

Creating a budget is the foundation of financial organization. Start by tracking your income and categorizing your expenses to get a clear picture of where your money goes. Assign realistic spending limits to each category and adjust as needed to maintain balance. Staying disciplined and reviewing your budget regularly ensures you’re always in control of your finances.

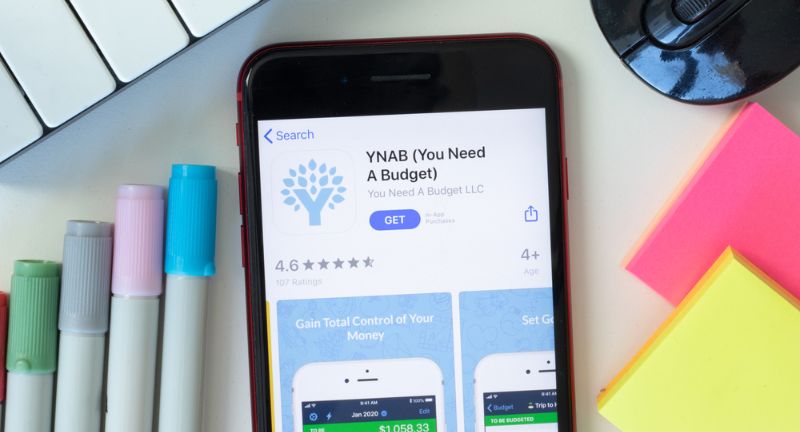

Use Budgeting Apps

Shutterstock

Technology can simplify financial organization significantly. Budgeting apps like Mint, YNAB, and PocketGuard help you track expenses, analyze spending patterns, and stay within your financial plan. These apps often sync with your accounts, giving you real-time insights into your financial health. Regularly using such tools eliminates guesswork and encourages better money management habits.

Set Financial Goals

Shutterstock

Having clear financial goals keeps you motivated and focused. Define specific short-term goals like saving for a vacation, mid-term goals like buying a car, and long-term goals such as retirement planning. Break down each goal into achievable steps and track your progress. Knowing your financial “why” helps you prioritize spending and stay on course.

Automate Bill Payments

Shutterstock

Late payments can hurt your credit score and incur fees. Automate bill payments for recurring expenses such as utilities, loans, and insurance. This ensures payments are made on time without manual intervention. With automation, you gain peace of mind knowing your obligations are consistently met.

Automate Savings

Shutterstock

Saving money becomes easier when you automate the process. Schedule automatic transfers from your checking account to your savings or investment accounts each payday. This method treats savings like a non-negotiable expense, ensuring consistent contributions. Over time, you’ll build a financial cushion without much effort.

Track Your Expenses

Shutterstock

Understanding where your money goes is crucial for staying organized. Track your expenses daily, weekly, or monthly using spreadsheets or budgeting apps. Analyzing this data can reveal spending patterns and unnecessary expenses. Adjusting your habits accordingly helps you optimize your financial plan.

Consolidate Your Accounts

Shutterstock

Managing multiple accounts can be confusing and time-consuming. Consolidating accounts, such as merging savings or credit cards, simplifies your financial life. With fewer accounts to track, you’re less likely to overlook transactions or miss payments. Simplification also helps when reviewing statements or filing taxes.

Organize Financial Documents

Shutterstock

Keeping financial documents organized ensures quick access when needed. Use digital storage solutions or a dedicated filing system for bills, receipts, tax returns, and insurance policies. Label and categorize files systematically to save time during tax season or financial reviews. Regularly update and back up important documents for added security.

Review and Update Insurance Coverage

Shutterstock

Insurance needs can change over time. Review your policies annually to ensure adequate coverage for your current situation. Adjust coverage if you experience life changes like marriage, home purchase, or starting a family. Keeping insurance up to date prevents potential financial pitfalls.

Monitor Your Credit Score

Shutterstock

Your credit score impacts loan approvals, interest rates, and even job applications. Regularly monitor your credit score through free online services or your bank. Watch for any unexpected changes that might indicate fraud or reporting errors. Maintaining a healthy score helps secure better financial opportunities.

Create a Debt Repayment Plan

Shutterstock

Debt can hinder your financial goals if left unchecked. Develop a plan by listing all debts along with interest rates and balances. Focus on paying off high-interest debts first while making minimum payments on the rest. As debts decrease, redirect those funds toward savings or investments.

Establish an Emergency Fund

Shutterstock

Unexpected expenses can strain your budget. Building an emergency fund helps cover medical bills, car repairs, or job loss situations. Aim to save 3–6 months’ worth of living expenses. Contributing consistently ensures financial stability during tough times.

Schedule Regular Financial Check-Ins

Shutterstock

Financial situations change, so regular reviews are essential. Schedule monthly or quarterly financial check-ins to assess your budget, savings, and goals. This proactive approach helps identify issues early and make necessary adjustments. Consistent monitoring keeps your finances aligned with your objectives.

Plan for Irregular Expenses

Shutterstock

Certain expenses, like holiday gifts, insurance premiums, or car maintenance, don’t occur monthly but can still disrupt budgets. Identify these irregular costs and save for them throughout the year. Setting up separate savings categories prevents financial surprises. Planning ahead ensures smoother cash flow management.

Automate Retirement Savings

Shutterstock

Retirement savings require long-term commitment. Automating contributions to retirement accounts like 401(k)s or IRAs guarantees consistent growth. The earlier you start, the more you benefit from compound interest. Treating retirement savings as a fixed expense makes it easier to reach your retirement goals.

Review Subscription Services

Shutterstock

Subscriptions can quietly drain your finances if left unchecked. Periodically review all active subscriptions, including streaming services, apps, and memberships. Cancel any that are no longer used or necessary. Reducing these costs frees up funds for more important goals.

Use Separate Accounts for Different Goals

Shutterstock

Organizing your savings with dedicated accounts for different goals makes tracking easier. For example, have separate accounts for vacations, home renovations, and emergencies. This method provides clarity and prevents unintentional spending of funds earmarked for specific purposes. Watching each account grow also boosts motivation.

Learn About Taxes

Shutterstock

Taxes are an unavoidable part of financial life. Educate yourself on available deductions, credits, and deadlines to avoid overpaying or penalties. Utilize tools like tax software or consult a professional if needed. Being tax-savvy ensures you retain more of your hard-earned money.

Seek Professional Advice

Shutterstock

Financial decisions can be complex and overwhelming. Consulting a certified financial planner provides personalized strategies for budgeting, investing, and retirement planning. Professionals help identify risks, optimize your portfolio, and maximize savings. Their expertise can offer peace of mind and long-term financial success.

Conclusion

Shutterstock

Being financially organized doesn’t have to be overwhelming. By implementing these strategies, you can create a system that makes managing your money easier and more efficient. From budgeting and saving to planning for the future, each step you take brings you closer to financial stability. The key is consistency, patience, and a willingness to adapt as your circumstances change. Start today, and enjoy the confidence that comes with knowing your finances are under control.

Related Topics:

More Money + Investing

-

20 Things You Should Never Leave in a Will

-

20 Indulgent Purchases That Trap the Middle Class

-

25 Indicators That Your Old Watch is Actually Really Valuable

-

5 Things That Are No Longer Worth Buying

-

24 of the Fastest Ways to Build Passive Income

-

5 Top Remote Jobs For Baby Boomers

-

6 Tax Mistakes Made By The Middle Class Every Year

-

Social Security Adjustments Coming In 2024 – Here’s What You…

-

25 Ways to Simplify and Save During a No Spend…

-

7 Once Affordable Things That Are No Longer Worth It

-

I Won the Lottery! Now What? A Guide to Staying…

-

Low Stress Jobs That Pay Over $70,000