NEWS

Biden Aims for Historic High with 44.6% Capital Gains Tax Proposal

Published

9 months agoon

Shutterstock

In a crucial move to reshape the financial landscape, President Biden’s tax proposals for fiscal year 2024 highlight a strategic shift in America’s tax policy. These reforms notably include a significant increase in capital gains taxes, primarily targeting the nation’s wealthiest individuals. By suggesting a substantial rise in the capital gains tax rate for high-income earners and overhauling related tax laws, the administration aims to create a fairer tax system, boost funding for essential social programs, and tackle the escalating fiscal deficit.

Implications for Long-term Investments

Shutterstock

The administration aims to align the tax rates of wage income and investment income by taxing long-term capital gains and qualified dividends at ordinary income rates for high earners.

Comparison to Previous Tax Policies

Shutterstock

These proposals represent a significant departure from the policies of earlier administrations, especially the tax reductions put in place during the Trump administration.

Public and Expert Opinions

Shutterstock

Reactions from both the public and experts are mixed. Some individuals are praising the emphasis on social equity, while others are concerned about the possible negative effects on investment and economic growth.

Details of the Capital Gains Tax Hike

Shutterstock

The proposed policy increases the federal capital gains tax rate from 20% to 39.6% for individuals with annual earnings exceeding $1 million. Moreover, the net investment income tax would rise from 3.8% to 5% for those with incomes above $400,000, leading to a maximum effective rate of 44.6% for certain high-income earners.

Funding for Medicare and Social Programs

Shutterstock

The planned hike in the Medicare tax rate aims to strengthen the program’s financial stability, guaranteeing its availability for future recipients.

Updates on Tax Deduction and Credit Policies

Shutterstock

The proposal encompasses the broadening of several tax credits, including the Child Tax Credit and the Earned Income Tax Credit. Additionally, it implements restrictions on deductions for high-income individuals by setting caps on deductions for like-kind exchanges.

Summary of Planned Modifications

Shutterstock

The budget proposal for fiscal year 2024 by President Biden features substantial hikes in capital gains taxes. These increases are mainly aimed at high-income individuals and large corporations to support an array of policy programs.

Support for Low and Middle-Income Families

Shutterstock

The plan proposes improving tax benefits for families. This includes making the expanded health insurance tax credits permanent and creating credits for first-time homebuyers.

Income Thresholds and Impact

Shutterstock

The revised tax rates are set to affect individuals with incomes surpassing specific thresholds, with the objective of having higher-income taxpayers contribute a larger portion to federal revenues.

Rationale Behind the Tax Reforms

Shutterstock

The purpose of the tax reforms is to mitigate income inequality by mandating higher payments from the richest Americans, underscoring the administration’s dedication to fairness and financial accountability.

Future of the Proposal

Shutterstock

Ongoing debates will largely influence the future of Biden’s tax proposal, hinging on the political dynamics in Washington and the administration’s capacity to negotiate and compromise with lawmakers.

International Tax Compliance Initiatives

Shutterstock

Revisions to global tax regulations, featuring changes to the taxation of overseas earnings and the imposition of taxes on global enterprises, constitute a key element of the comprehensive tax policy.

Political Hurdles for Proposed Tax Hikes

Shutterstock

The suggested tax hikes are encountering strong resistance in Congress, especially from Republican members, casting doubt on the likelihood of these measures being approved.

Impact on Estate and Gift Taxes

Shutterstock

Proposed new regulations would classify transfers of appreciated property, whether through gifting or upon death, as taxable occurrences. This represents a substantial shift in the tax consequences associated with estate planning.

Economic Forecasts and Criticisms

Shutterstock

Economic studies indicate that the proposed tax hikes may slightly slow down economic growth. However, these increases are crucial for financing vital public services and decreasing the national deficit.

Conclusion

Wikipedia

President Biden’s capital gains tax proposal represents a bold effort to reshape the financial responsibilities of America’s wealthiest, aiming to ensure a fairer contribution to the nation’s economic health. The plan faces significant opposition and its future remains uncertain in a deeply divided Congress. However, its effects extend beyond immediate financial outcomes, hinting at a transformative impact on wealth distribution and social justice. As discussions and debates progress, the outcome of these proposals will significantly influence the United States’ economic and social landscape, potentially setting a precedent for future tax policy reforms in an era marked by profound inequality.

More Money + Investing

-

24 Cars to Buy Now Before Their Value Skyrockets

-

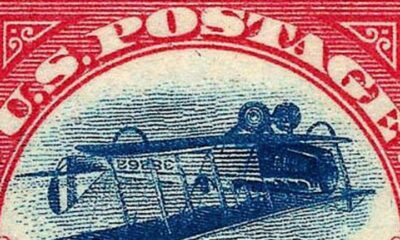

18 Ultra-Rare U.S. Stamps Worth a Fortune

-

21 Brands That Have Stirred Up The ‘Woke’ Debate

-

15 Spending Habits That Shout ‘I’m Flat Broke!’

-

25 Epic Car Flops That Made History

-

10 Beloved Vintage Car Features Lost to Time

-

21 Energy-Hungry Home Gadgets That Spike Your Monthly Power Bill

-

20 WWII Military Marvels That Redefined Warfare

-

15 Bad Habits Keeping You From Being A Millionaire

-

Snowflakes and 17 Conservative Stereotypes That Drive Democrats Up the…

-

30 Aldi Treasures You Can’t Leave Without

-

Rue21 Bows Out: Another Retailer Closes All Doors