ECONOMY

Unemployment Ticks Up to 3.8% In August Jobs Report

Published

1 year agoon

Courtesy of khiemh/Instagram

The U.S. economy added 187,000 jobs in August, after adding the same number in July, according to the August jobs report released Friday by the Bureau of Labor Statistics.

Unemployment ticked up to 3.8% in August, after hovering between 3.4% and 3.7% for more than a year. Employment continued to trend upward in health care, leisure and hospitality, social assistance, and construction, the agency said, while employment in transportation and warehousing declined.

Among the unemployed, the number of those who lost their jobs or completed temporary jobs in August rose by 294,000 to 2.9 million, countering July’s decrease of 280,000, the agency said.

Labor force participation rose in August by 0.2% to 62.8%, after being flat since March. The number of those not in the labor force who wanted a job stood at 5.4 million.

Average hourly earnings for all workers on private, nonfarm payrolls rose by 8 cents in August, to $33.82, the agency said.

The figures represent a slight cooling in the previously hot job market, with fewer job openings but not extensive layoffs.

“It’s no surprise that the job market is cooling off. Small businesses are beginning to face the headwinds of expanding their business when the cost of borrowing is double digits,” said Ted Jenkin, founder and CEO of Atlanta-based oXYGen Financial.

The Federal Reserve has been raising interest rates since March of last year, in an effort to bring inflation down to its 2% target. In July, the Fed approved another interest rate hike, bringing the target range for the federal funds rate to 5.25 to 5.5 percent, the highest level since 2001.

“Both Fortune 500 companies and local Mom and Pop businesses are experiencing the challenges of high interest and ongoing inflation. Inflation may have come down, but that doesn’t mean prices have come down. They are just going up slower,” Jenkin said.

The Fed has previously indicated that higher unemployment levels would be necessary to bring down runaway inflation, but so far employment levels have only modulated slightly.

TMX contributed to this article.

Related Topics:

More Money + Investing

-

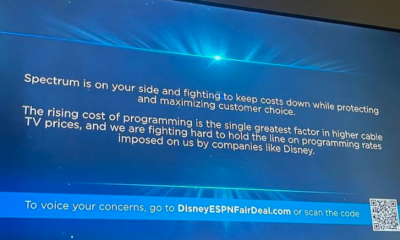

Disney Pulls All Its Channels From Charter Spectrum In Contract…

-

Rite Aid May Be Headed For Bankruptcy Amid Opioid Lawsuits

-

Goldman Sachs Lowers US Recession Chances To 15% Over Next…

-

8 Great Part-Time Jobs For Retirees

-

7 Reasons Why The IRS Will Audit You This Year

-

Taco Bell Tops Entrepreneur’s Franchise 500 List for Third Year…

-

20 Quirky Tax Breaks You Should Know Before You File

-

Student Loan Interest Resumes Sept. 1, With Payments Due in…

-

Overtime Pay Could Extend To Millions Of Salaried Workers Earning…

-

From Eco-Friendly Startup to Amazon Dominance: The Story of One…

-

10 U.S. Cities People Are Fleeing In Droves

-

Elon Musk Threatens To Sue Anti-Defamation League Over Declining X…