ECONOMY

7 Reasons Why The IRS Will Audit You This Year

Published

2 months agoon

Shutterstock

Navigating the complexities of tax law and IRS regulations can be daunting, and understanding what might trigger an IRS audit is crucial for both individuals and businesses. An IRS audit involves a review of an entity’s accounts and financial information to ensure information is reported correctly according to the tax laws and to verify the reported amount of tax is correct. While audits can seem intimidating, being aware of the common triggers can help in preparing accurate and compliant tax returns. This guide explores fifteen potential reasons why the IRS might audit a taxpayer, ranging from income discrepancies to questionable deductions. By being informed, taxpayers can take proactive steps to minimize the risk of facing an audit.

Unusually High Income

Shutterstock

The IRS often flags returns with significantly higher income than previous years for review. High-income earners are statistically more likely to be audited due to the potential for larger tax errors or omissions. Additionally, the complexity of financial transactions at higher income levels can often lead to discrepancies or mistakes in tax filings.

Failure to Report All Income

Shutterstock

Neglecting to report all sources of income, whether intentional or accidental, is a common trigger for an IRS audit. This includes income from employment, investments, business earnings, and any other sources. The IRS receives copies of all W-2s and 1099 forms, so any mismatch between these forms and your return can easily flag your account for review.

Excessive Claims for Charitable Donations

Shutterstock

Claiming charitable deductions that are disproportionately high relative to income can raise red flags with the IRS. Taxpayers are expected to keep detailed records and receipts of their donations. Exaggerated or unsubstantiated claims of charitable giving are a common cause for audits.

Home Office Deduction

Shutterstock

The home office deduction is often scrutinized by the IRS. To qualify, the space must be used regularly and exclusively for business, and it must be the principal place of your business. Audits may occur if the deduction is high relative to income or if the criteria for the home office are not clearly met.

Claiming Rental Losses

Shutterstock

Real estate investors who claim rental losses, especially those who are classified as “real estate professionals,” can attract IRS attention. The passive activity loss rules can be complex, and errors or aggressive interpretations of these rules can lead to audits.

Overstating Business Expenses

Shutterstock

Excessive deductions for business expenses, especially when they significantly reduce taxable income, can trigger an audit. The IRS is aware of average expense ranges for various industries and flags returns that deviate significantly from these norms. It is important to keep thorough records to substantiate all business expenses.

Failing to Report Foreign Bank Accounts

Shutterstock

Not reporting foreign bank accounts can lead to severe penalties and audits. U.S. taxpayers are required to report foreign financial accounts if the total value exceeds certain thresholds. The IRS receives information from foreign banks and compares it to U.S. tax returns for discrepancies.

Participating in Tax Shelters

Shutterstock

Involvement in complex tax-avoidance strategies, often marketed as “tax shelters,” can lead to audits. These schemes are typically designed to artificially reduce taxable income through contrived transactions. The IRS actively investigates such arrangements and often subjects participants to audits.

Using Round Numbers

Shutterstock

Frequent use of round numbers in a tax return can suggest estimation or fabrication of deductions and expenses. The IRS looks for signs of accuracy in reporting, and too many rounded figures can appear as though numbers are being made up or estimated without proper documentation.

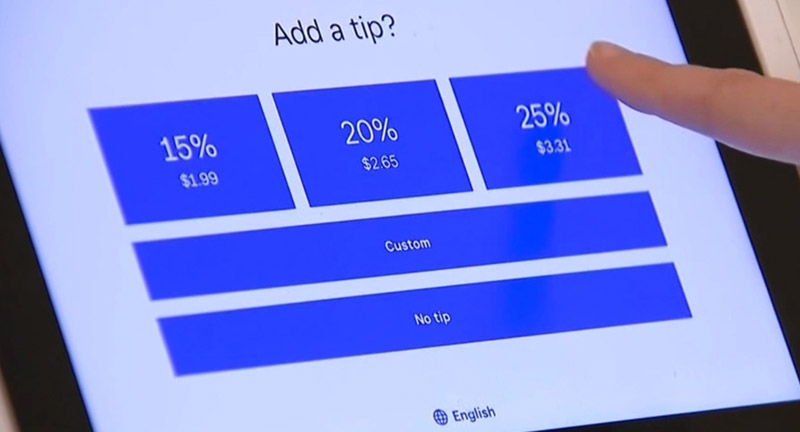

Earning Substantial Income from Tips

Shutterstock

Individuals who earn a large portion of their income from tips, such as restaurant or service industry workers, are often on the IRS radar. Tips are frequently underreported, and discrepancies between reported income and lifestyle can trigger an audit.

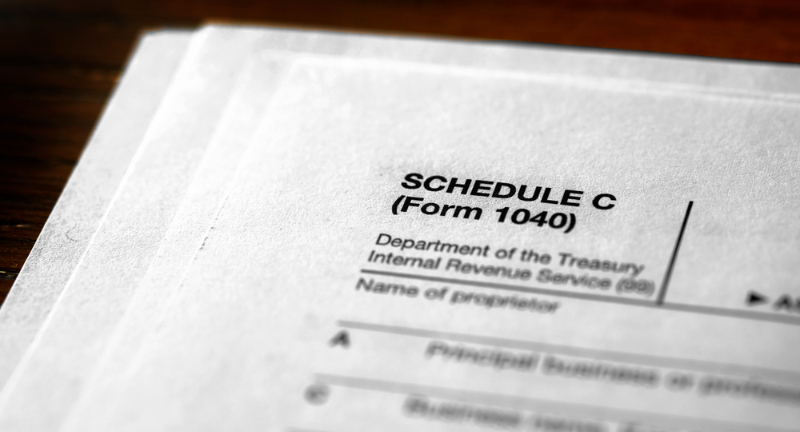

Large Losses on Schedule C

Shutterstock

Reporting large losses on Schedule C, especially if those losses consistently exceed income, can raise suspicions. The IRS may question whether the business activity is genuinely engaged in for profit or is merely a hobby, which has different tax implications.

Errors and Inconsistencies

Shutterstock

Simple mistakes, such as math errors or inconsistent information, can prompt an IRS audit. These errors may be seen as red flags for larger issues or may simply require clarification. Ensuring accuracy and consistency in all aspects of a tax return is crucial to avoid unnecessary IRS scrutiny.

Cash Transactions

Shutterstock

Businesses that deal predominantly in cash, such as restaurants, salons, or retail stores, are more likely to be audited. The IRS is aware that cash transactions can easily go unreported, and therefore, it pays extra attention to businesses operating largely in cash. Large cash deposits or withdrawals also tend to be closely monitored, as they can indicate unreported income.

Investment Income Discrepancies

Shutterstock

Discrepancies in reporting investment income can trigger an IRS audit. This includes income from stocks, bonds, mutual funds, and other investments. The IRS receives information from brokers and financial institutions and matches this with the taxpayer’s reported income. Any mismatch or omission can lead to scrutiny.

Claiming Losses from a Hobby

Shutterstock

Reporting losses from activities that could be considered hobbies, rather than legitimate businesses, is a common audit trigger. The IRS uses specific criteria to distinguish between a hobby and a business, primarily focusing on profit motive and business-like operations. Consistent reporting of losses from activities like art, music, or other personal interests can prompt an audit to determine the true nature of the activity.

Conclusion

Shutterstock

While the prospect of an IRS audit can be unsettling, understanding the common triggers for such reviews can significantly reduce the likelihood of being audited. It’s important to report all income accurately, avoid excessive claims, maintain thorough records, and be aware of the nuances in tax laws, especially in areas prone to scrutiny such as home office deductions, foreign accounts, and cash transactions. Remember, the key to avoiding IRS audits is not just in being compliant, but also in being meticulous and transparent in your financial reporting. By adhering to these principles, taxpayers can foster a sense of confidence and integrity in their tax filings, thereby minimizing the stress and uncertainty associated with IRS audits.

Related Topics:

More Money + Investing

-

Federal Reserve Approves Fourth Consecutive Rate Hike

-

More than 1.1 million fewer job vacancies reported in August

-

Taco Bell Tops Entrepreneur’s Franchise 500 List for Third Year…

-

Elon Musk claims that if oil and gas aren’t utilized…

-

Jack Dorsey wanted to get Elon Musk on Twitter’s board…

-

Jeff Bezos issues an economic warning

-

FTX Customer Sues Golden State Warriors For Promoting Failed Exchange

-

General Motors earnings are below Wall Street expectations

-

Judge orders Elon Musk to complete Twitter acquisition by October…

-

Boeing workers to strike

-

Oil price increases as Saudi Arabia suggests reducing production

-

United Buys 100 Boeing 787 Dreamliners, With Options For 100…